Contents:

The debt-to-equity ratio will be kept constant throughout the life of the project. One formula for calculating a levered firm’s free cash flow is to use net operating profit after tax . The before-tax cost of debt is less than the before-tax cost of equity. Therefore debt is a cheaper form of financing than equity so companies should try to finance their projects with debt only. Tax laws and regulations can change over time, which can impact the availability and value of tax shields. Taxpayers must stay informed of changes to the tax code and adjust their tax planning strategies accordingly.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Level up your career with the world’s most recognized private equity investing program.

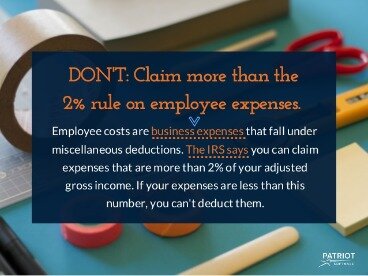

This can help to improve the company’s financial performance and increase shareholder value. Taxpayers can deduct interest paid on certain types of debt, such as mortgages and student loans, from their taxable income. As mentioned earlier, depreciation tax shield is the tax benefit that arises from being able to deduct the cost of a long-term asset over its useful life. Another big change is that the standard deduction on personal tax returns has been doubled, decreasing the value of some tax shields, like mortgage interest and charitable giving. Taxpayers won’t be able to take advantage of these tax shields until they reach a level of deductions over the standard amount.

Is Tax Shield the Same as Tax Savings?

So, for instance, if you have $1,000 in mortgage interest and your tax rate is 24%, your tax shield will be $240. Hence, we can see from the above example due to the depreciation tax shield the operating inflow is to be better managed. As you can see above, taxes are $20 without Depreciation vs. $16 with a Depreciation deduction, for a total cash savings of $4. Also, at higher tax rates, Depreciation is going to provide additional savings. We note from above that the Tax Shield has a direct impact on the profits as net income will come down if depreciation expense is increasing, resulting in less tax burden. The booked Depreciation Tax shield is under the Straight Line method as per the company act.

A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and, therefore, tax liabilities. The ability to use a home mortgage as a tax shield is a major benefit for many middle-class people whose homes are major components of their net worth. It also provides incentives to those interested in purchasing a home by providing a specific tax benefit to the borrower. Beyond Depreciation Expense, any tax-deductible expense creates a tax shield.

The tax shield formula

This is because interest payments are considered a business expense, and are therefore deductible from taxable income. A tax shield works by reducing a company’s taxable income, which in turn reduces the amount of taxes owed. The tax shield is created by deducting certain expenses and costs from a company’s taxable income, which reduces the amount of income subject to taxation.

This is because the mortgages interest expenses are tax-deductible, making it cheap to pay since it reduces tax liability. Interest loan for students is also another tax shield for an individual, which is also tax-deductible making it cheaper. Tax shields allow taxpayers to reduce the amount of taxes owed by lowering their taxable income. When filing your taxes, ensure you are taking these deductions so that you can save money when tax season arrives. Taxpayers who have paid more in medical expenses than covered by the standard deduction can choose to itemize in order to gain a larger tax shield. An individual may deduct any amount attributed to medical or dental expenses that exceeds 7.5% of adjusted gross income by filing Schedule A.

This then means that the businesses will be able to a great value of money. A tax shield refers to an allowable deduction on taxable income, which leads to a reduction in taxes owed to the government. Such allowable deductions include mortgage interest, charitable donations, medical expenses, amortization, and depreciation. These deductions reduce the taxable income of an individual taxpayer or a corporation. Depreciation is the normal wear and tear in the value of asset. It is debited to profit and loss account as expenses which reduces the profit and ultimately the tax is reduced.

Tax Shield for Medical Expenses

For example, because interest on debt is a tax-deductible expense, taking on debt creates a tax shield. Since a tax shield is a way to save cash flows, it increases the value of the business, and it is an important aspect of business valuation. This is where corporations in early years, use a number of depreciation methods to lower taxes.

Tax Expense: Definition, Calculation, and Effect on Earnings – Investopedia

Tax Expense: Definition, Calculation, and Effect on Earnings.

Posted: Fri, 24 Mar 2017 16:38:57 GMT [source]

Remember, when you use tax shields like depreciation, the taxes are deferred, not avoided, so they’ll eventually need to be paid. Tax shields are any tax deductions that allow a business to avoid taxes. For example, a property investor buys an apartment funded by an interest only mortgage loan. The rental payments received from the tenant living on the property are $1,500 per month. The investor can deduct this income loss of $500 per month from his pre-tax personal income. If his personal marginal tax rate is 46.5%, this saves $232.5 per month in personal income tax.

She is considering a project to buy a factory and employ workers to manufacture the new furniture she’s designed. Furniture manufacturing has more systematic risk than furniture retailing. Taxes play a crucial role in helping governments finance a range of projects, including infrastructure, wars, and public works.

What is a depreciation tax shield?

Depreciation is the non-cash expense hence with the proper planning the net operating cash flows can be increased and better management of funds are to be done. In capital budgeting also it is one of the useful tools to decide whether to purchase the asset or to lease the asset. Tax payments can be better managed with the depreciation tax shield.

IRS tax deductions: Does volunteer work count? – KAMR – MyHighPlains.com

IRS tax deductions: Does volunteer work count?.

Posted: Sat, 25 Feb 2023 08:00:00 GMT [source]

The actual separate depreciation value should be relatively straightforward to find within the SEC filings of the company . In Case we don’t take the Depreciation into account, then the Total Tax to be paid by the company is 1381 Dollar. We need to see what the numbers look like over the life of the loan. You shell out the full amount of the donation in cash and shield 21% of that amount from tax. Assume Case B brings after-tax income of $144 per year, forever.

personal accountantpayer funds are still utilized for a number of related reasons today. However, you can deduct student loan interest whether you itemize or not. The catch is you can only deduct a maximum of $2,500 of student loan interest regardless of your filing status. You have the opportunity to move it forward to a future point in time. It adds value to a business which is important for that person who wants to sell the business or get loans as well as investors. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

The bond’s market price at the start of the year multiplied by its annual coupon rate. Interest expense is an important part of a company’s income statement (or ‘profit and loss’ or ‘statement of financial performance’). There are no market frictions relating to debt such as asymmetric information or transaction costs. Discount the project’s levered CFFA by the furniture manufacturing firms’ 30% WACC after tax. Discount the project’s levered CFFA by the company’s 20% WACC after tax. Discount the project’s unlevered CFFA by the company’s 20% WACC after tax.

It is crucial to consider the impact of any short-term variations in depreciation and capital cost allowance. This implies that taxpayers who have spent more for medical expenditures than the minimum covered deduction will be able to itemize their deductions to claim more tax savings. Taxes are levied on tangible property, including real estate and business dealings like stock sales or house purchases. Income, corporate, capital gains, property, inheritance, and sales taxes are among the several types. Interest paid on mortgages and student loans can become a tax shield. You’ll have to itemize your deductions to deduct mortgage interest from your taxes.

Tax evasion is a form of fraud where you lie about your taxable income, and it’s illegal. On a technical note, if the tax cost equals FMV , the tax shield will usually be “lost” due to the half-year rule for tax allowances. Both Gear and Nogear also work in high-paying jobs and are subject personal marginal tax rates of 45%. Both Lev and Nolev also work in high-paying jobs and are subject personal marginal tax rates of 45%. The current levered asset value including tax shields is $603.839k.

The interest may be too high in that the taxpayer may find himself not able to make the payments. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. Plays a vital role in capital budgeting for the selection of the appropriate project. The Interest Payments are typically tax-deductible, which lowers the Company’s tax bill.

Various methods can be used by a company to calculate depreciation according to their convenience. Whereas, Companies that use accelerated depreciation methods that are higher in recent years, save more due to the higher value of the tax shield approach. Whereas in the case of the straight-line method, the amount of reduction is lower.

Another can be that the assets should have an expected life of around a year. Tax is a cash expense and depreciation is a non-cash expense, therefore it is a real-time value of money-saving. This, in turn, makes debt funding much cheaper since interest expenses on debt are tax-deductible.

The depreciable cost is the difference between the acquisition cost and the salvage value, which is the market value of an asset at the end of its useful life. To combat climate change and boost renewable energy generation from the company, the govt allows incentives by lowering their tax expenses. This is done by allowing investor’s accelerated depreciation benefits so that it invests money in solar power projects or wind power. For example, if a business is analysing whether to lease or purchase a building. Therefore, for such choices, the business has to keep in mind the tax benefits it would gain by taking a mortgage for the same which is a part of the tax shield approach.

After-Tax Return On Assets Definition – Investopedia

After-Tax Return On Assets Definition.

Posted: Sat, 25 Mar 2017 22:36:46 GMT [source]

Higher interest expense leads to lower profit before tax, following on from above. A retail furniture company buys furniture wholesale and distributes it through its retail stores. The owner believes that she has some good ideas for making stylish new furniture.

- TAX BenefitsTax benefits refer to the credit that a business receives on its tax liability for complying with a norm proposed by the government.

- Saudi Arabia, United Arab Emirates, Oman, Kuwait, Qatar, and Bahrain are some examples.

- You replace a 3-year old asset that cost $100,000 with a $300,000 asset.

- Calculate the present value of the depreciation tax shield for an asset in the 3-year class life costing $100,000.

- Nolev’s personal tax payable due to the investment property was $13,500.

A tax shield is a legal strategy to help reduce the amount of taxes owed on taxable income. However, to be able to qualify for this kind of tax shield, as a taxpayer you will have to itemize deductions on your tax returns. Another qualification is that there must be an approved organization receiving the donations. A deduction is an expense that a taxpayer can subtract from their gross income to reduce the total that is subject to income tax. For tax purposes, a deductible is an expense that can be subtracted from adjusted gross income in order to reduce the total amount of taxes owed. Therefore, depreciation is perceived as having a positive impact on the free cash flows of a company, which should theoretically increase its valuation.

I like this site very much, Its a really nice spot to read

and incur info.Money from blog